If you have never set a budget before this blog post is for you.

Finances can seem intimidating because unfortunately, it’s not something that we are thought in school. Then we find ourselves wondering how a 401k or a Roth IRA is. Well before we focus on that we have to focus on taking small steps to manage money.

It’s scary to know that so many people have lost their jobs during COVID and that many are struggling to keep afloat with their payments of things.

This is why budgeting and learning about personal finance is so important and that can be vital during your 20’s

It’s time that you manage money, not that money manages you.

The word *budgeting* can seem intimidating especially for people that may have never had one before.

I know this was me.

By budgeting, you get a sense of empowerment. You no longer are wishing for another payday because you know exactly where all of your money is going and you have a plan for every single penny.

I am a millennial and maybe you are too, which is why I made this into list form because for some reason it’s easier to understand. Regardless of your age personal finance is something that we all have to learn at some point in our lives.

This can be tailored to YOU some people might be students and get financial aid which means they might have a wide influx of money coming in one month but not for the rest of the year and they have to create a budget for it for the next 5-6 months. You can also print out the budget printable for the month and calculate how much you will need for that month and subtract it from the amount that came in.

SET IT UP

First, figure out how much money you have coming in. By writing down how much money you have coming in you can allocate it to its designated place. For Instance, you can always write how much you have coming in from your paychecks and you can also write money coming in from side hustles, etc. For the first two months focus on just writing down your incoming money and your expenses.

Don’t worry about creating a budget for the first two months because you want to see where most of your money is going when you don’t create a budget.

You can write it down on a piece of paper or if you prefer digital you can always use an app. One of my favorites is Mint and another is Empower (you do have to pay monthly for this one).

In the beginning, it’s just about knowing where all of your money is going.

CREATE CATEGORIES & A BUDGET

When you have an idea of how much you spend vs. how much you make it’s time to create a budget and create categories & figure out how much you need to spend on that category. For Instance, you might realize from tracking the first two months that you spend a lot of food on eating out, and by budgeting yourself on how much you spend on food you might figure out ways in which you can save. For Instance, by making lunch or meal prepping.

CREATE A REALISTIC BUDGET

If you start by cutting everything back and you have never budget yourself before then it is going to be hard to stick to a budget. Try by doing small goals such as cutting one part of your budget such as eating out or buying clothes etc.

You can make the goal of saving $20 every week. That is a goal that is more doable by most people and then when you feel like you are doing well with that goal you can move on to something a bit more challenging.

CREATE A VISION BOARD

It’s difficult to follow a goal when you start especially if it’s something that you don’t have present with you all of the time. By creating a vision board that you look at every single day that way you always have your goal present.

Having your “why” present at all times is what is going to help you get through the tough times when it comes to budgeting because sometimes it is hard when you want to buy have a whole new closet with a great wardrobe.

Instead focus on what your goal is, such as traveling. Maybe your goal is to pay off your debt so that you can move to a new city, maybe your goal is to finally buy a house, etc.

Having that goal present is important and an image that represents that goal is important so that you don’t lose sight of your why.

ALWAYS REFLECT & MODIFY

Something that I have learned is to reflect and modify things. Keep a journal of how you feel during this journey. How are things going for you? if something is not working ALWAYS turn things around and retry again.

If you find that something you have been doing then you can always retry again and this goes with all kinds of things in life.

Maybe you realized that you cut back on beauty products and that it’s making you miserable try making it something that you reward yourself every three months if you achieve a specific goal.

BABY STEPS

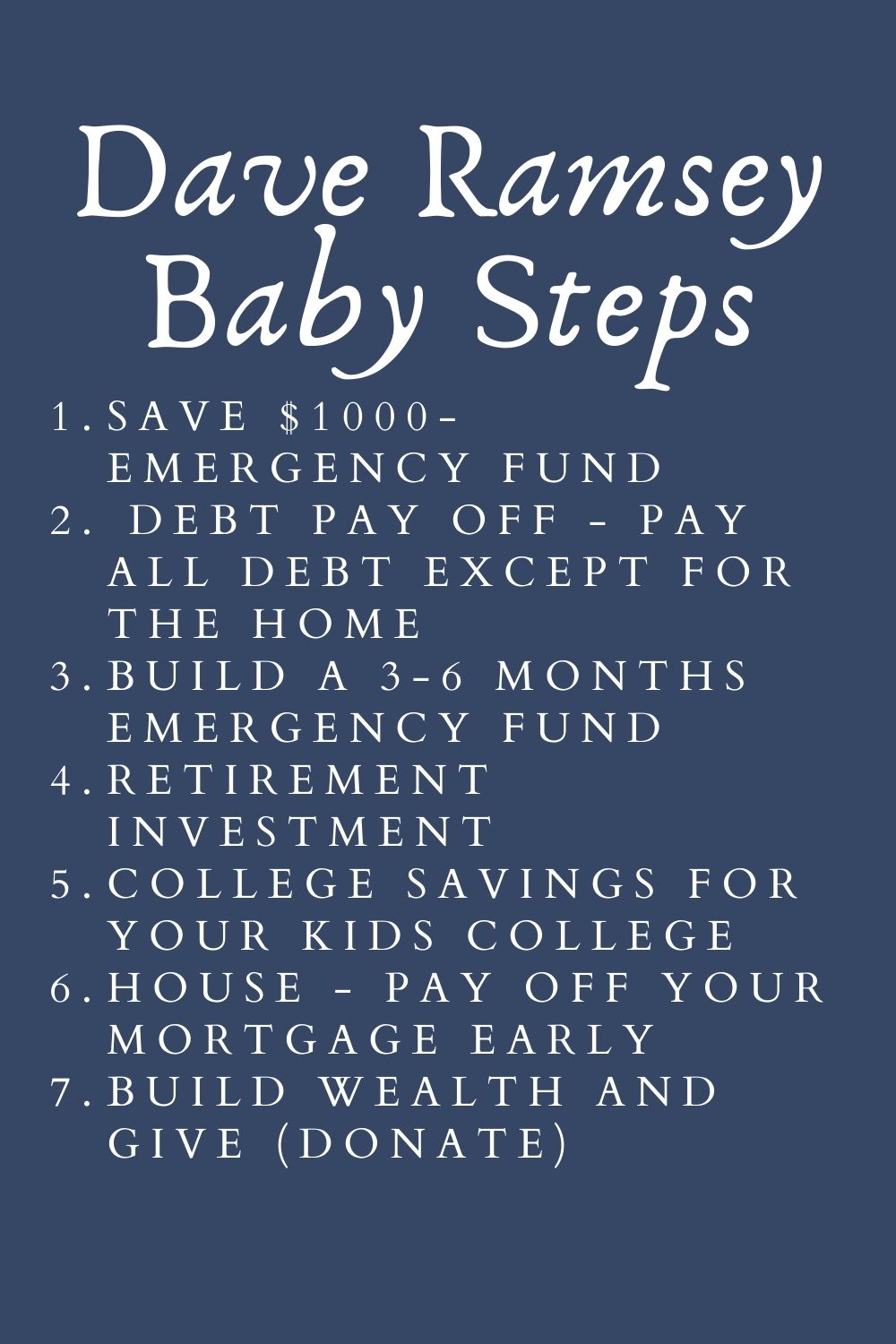

I’ve been following Dave Ramseys Baby Steps. I like to watch his videos on YouTube as a daily source of inspiration. You don’t have to follow him but you can always find people that you admire where they are going with their financial journey and do what they are doing.

USE THE ENVELOPE SYSTEM

By using the envelope system you will know exactly where most of your money is going. This is especially important for people that use their card for everything and don’t look at their statement until they see that it has a negative balance. If that’s not you then this tip might not be for you, but if you find that you never know how much money you have in the bank and you treat your credit card like a place where you know that if you no longer have money for that item then you can’t spend it anymore.

FIND OTHERS THAT ARE IN THE SAME BOAT AS YOU

In the same way that I found people that are following the Baby Steps find people that are in the same boat as you. It can be hard to stick to a budget when you are surrounded by people that want to go out every weekend and want to hang out with you by going to expensive restaurant constantly, etc so by keeping a group of people around you that are doing the same thing as you that can keep you motivated.

YOU HAVE TO BE OBSESSIVE

The reality is that if you want to achieve that financial goal you always wanted it is not going to be easy. You have to obsess over that goal. Do you want to own a home? Well, you have to obsess over achieving that goal and learning everything you can about achieving that goal.

Printable

Simple Art Inspiration Printable Worksheet-3

Link to similar posts

Question For You:

If you didn’t grow up with your parents teaching you how to manage your money, when did you learn that and also what changes did you make? Was it something immediate or was it something that you continue working overtime?